Trading Plan: Key Takeaways

- The keys to building a personalized trading plan…

- How to fit your plans to your unique trading style…

- Discover how trading plans help me find the day’s potential movers within 60 seconds of the market open…

See this BEFORE the market opens tomorrow!

It can be hard to navigate the markets in today’s crazy world. Constructing a bullet-proof trading plan that will carry you through is a must … It can be the difference between surviving and fading out of the market.

How do you do that? Let me show you…

Table of Contents

- 1 What Is a Trading Plan?

- 2 Do You Need a Trading Plan?

- 3 Planning: The Key to Long-Term Trading Success

- 4 Trading Plan Essentials

- 5 6 Tips for Creating a Useful Trading Plan

- 6 Trading Plan Examples

- 7 Trading Plan and Trading System: What’s the Difference?

- 8 How to Combine Your Goals With Your Trading Style

- 9 Long-Term Benefits of Trading Plans

- 10 Frequently Asked Questions About Trading Plans

- 11 Who Uses a Trading Plan?

- 12 Can I Alter My Trading Plan Any Time?

- 13 What Key Elements Should Be in a Trading Plan?

- 14 What’s Next?

- 15 Conclusion

What Is a Trading Plan?

It’s your outline of a given trade. It defines why you’re making the trade and how you’ll execute it.

A good plan takes into account your trading style, risk management, and expectations. It lays out your entire approach to trade, from the ticker to your entry, exit, goals, stops, and more.

Traders who build thorough plans and follow them are more likely to keep a level head — and less likely to make big mistakes…

Do You Need a Trading Plan?

Trading plans aren’t sexy. Many traders are quick to dismiss them as unnecessary. They’d rather focus on the more exciting aspects of trading … like hot stocks, chart spikes, or catalysts.

Big mistake! While those things can help you choose stocks to trade, you need to combine them with a plan to get the best results.

Technically, no, you don’t need a plan to make a trade … But if you want to follow the trajectory of consistent traders before you, you’d be smart to use one.

A good way to build a trading plan to fit your account is to use an all-in-one trading platform like StocksToTrade. It has the essential trading tools and features that can help you formulate a game plan for each day. Try StocksToTrade today — start your 14-day trial now!

Planning: The Key to Long-Term Trading Success

© StocksToTrade

A trading plan gives you a clear-cut plan of attack for entering and exiting a trade.

It’s the difference between a calculated trade and the ‘hold and hope’ mentality that causes so many traders to lose money.

You know how I feel about bag-holding (DON’T DO IT)…

Without a plan, you’re pretty much gambling. You might win here and there, but your progress won’t be as reliable as it would be with a plan in place.

Many traders who don’t use plans begin to see their losses exceed their gains, and they ultimately give up on day trading.

Don’t become a cautionary tale … Make a plan every time!

Trading Plan Essentials

Your plan for a trade should cover essentials such as an entry/exit plan, risk management, and trading goals.

- An entry/exit plan should cover the key points at which you’ll enter a trade (buy) and when you’ll exit a trade (sell)…

- Risk management is all about limiting your losses. The less money you lose — especially in your early trades — the longer you can stay in the game. This can help you build healthier long-term trading habits. Determine how much you’re willing to lose on every trade. Not every trade will be a winner.

- Stop-loss orders and limit orders are great ways to help minimize risk. Losses are part of the game. Be ready to cope with that.

Each trader’s plan is unique. There’s no one plan to fit all. Build one that best suits your trading needs and goals.

6 Tips for Creating a Useful Trading Plan

Now that you understand the benefits of building plans for your trades, here are some tips on how to do it…

#1. Set Goals

What do you hope to gain from this trade? Do you want a 10%, 20% gain? Set realistic profit goals.

And if you’re new, it can help to start small. Then increase your goals as you become consistent. Focus on gaining practice and experience.

Some of the best stock traders recommend starting small. You can size up once you learn and find some consistency.

#2. Focus on Risk

What’s your risk tolerance? Only YOU can answer that.

Before you enter a trade, consider how much of your portfolio you’re willing to risk on a given trade. Many traders stick to a rule of risking no more than 1% or 2% of their account.

If you have a small account, you may decide to risk a little more to gain a bigger position…

Or you may decide to risk less to try to nail down your process and avoid blowing through your account. Either way, only trade with money you can afford to lose. Trading is risky!

#3. Do Your Research

Before you enter any trade, do your research. Seek out the big gainers, study the stock charts, and research potential catalysts.

Be diligent! Research can help you determine how a stock might perform. You can never be 100% sure, but you want to be able to say you did all you could.

I find a lot of the big potential plays within 60 seconds of the market opening … But I wouldn’t know which ones I feel comfortable trading if I didn’t do my due diligence beforehand.

#4. Plan Your Entry and Exit

Make a specific plan about when you’ll enter and exit a trade.

Decide which buy signals will be your green light to enter a trade and only enter when you see them. StocksToTrade’s Oracle Scanner does a wonderful job of showing good entry and exit points.

The exit is just as important as the entry, if not more … Consider what you’ll do if a trade starts going south.

What’s your stop loss? When will you get out if things don’t go your way? Resolve to get out at this point, and don’t take it personally. Never trade on your emotions.

Using easily identifiable chart markers like the low of the day can be a good point of support to set risk. And certain resistance levels, like the high of day, can act as good points of entry.

Know your profit target, too. Get out once the trade hits your goal. Don’t get greedy.

#5. Write It Down

Write down your plan. Literally.

There’s a sense of accountability that comes with physically writing down your plan. And keep it where you’ll see it.

It’s another way to hold yourself accountable. And you have that information to review for future trading…

Trading is a game of lessons. Knowing what works and what doesn’t helps guide your future trading.

#6. Review the Trade Afterward

After you make a trade, take time to consider how things went.

Keep your notes from your plans and on how your trades play out in a trading journal or log. That can give you insight into what went right or wrong. And again, you can use that knowledge in future trades.

You’ll get an idea of where you need to be more diligent.

Trading Plan Examples

Here are a few examples of a potential trading plan with some recent runners…

EZFill Holdings, Inc. (NASDAQ: EZFL) was a great example of one of my favorite patterns to trade — the dip and rip. It checked off a lot of boxes:

- Early-morning press release

- Hot sector

- Low floater

EZFL dipped before the market open and continued up. Your plan could have been to set your entry at an appealing premarket level and your exit close to that premarket high.

I personally would wait for it to reclaim premarket highs. But my plan doesn’t work for everyone. Some like to buy off the initial bounce.

EZFL tried that level a few times and failed, showing why it’s important to stick to your plan and not get greedy.

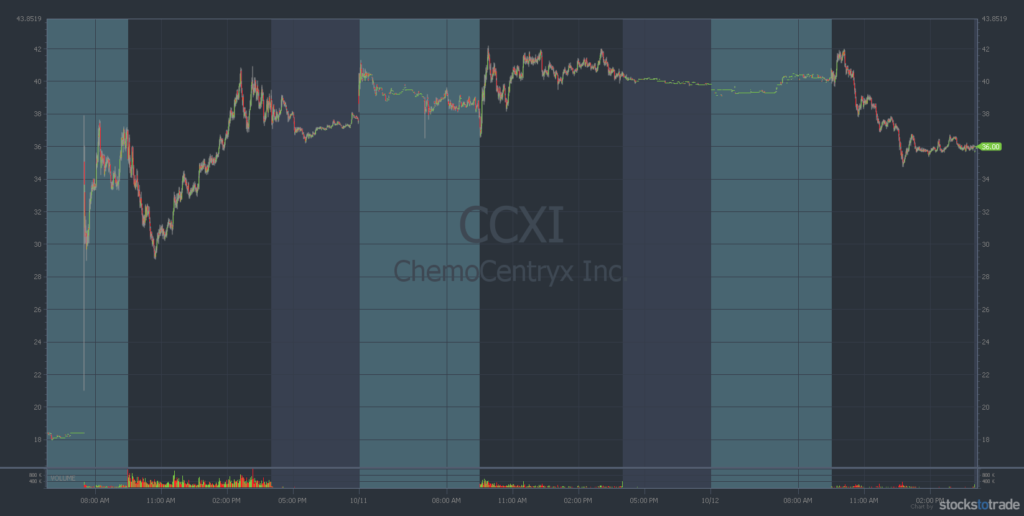

Another good example is ChemoCentryx, Inc. (NASDAQ: CCXI).

This was a swing trade idea as a weak open red-to-green…

It ran in previous days and was holding up despite a weak open. This showed it had the buyers to support its current level despite the huge gap-up days before.

It ended up running the next morning before finally seeing a sell-off…

You could have used a current day or prior day level of support as your risk and that well-defined top as your exit point.

Remember, write down all of these decisions as well as WHY you make them.

Trading Plan and Trading System: What’s the Difference?

Trading systems don’t rely on individual decision-making whatsoever … It relies on algorithms to determine everything.

This isn’t necessarily a bad thing. A lot of traders use this style.

A trading plan is more personalized. Also, algorithms can’t account for traders’ emotions.

Doing research and understanding how the market might react to a stock can give you a huge edge. It’s not just indicators and trading signals like a trading system.

How to Combine Your Goals With Your Trading Style

Every trader has different goals. Some want to day trade. Others want to hold long term. You may have to tinker around to find what suits you.

Do you know what kind of trader you are and what your goals are?

How often do you want to trade? What kinds of stocks do you want to trade? What’s your risk tolerance?

These are all important questions to ask yourself before you begin trading.

If you hold a 9-to-5 job, day trading may not work for you. You may want to swing trade or even hold stocks longer term.

The type of trading you choose should play a big role in your plans.

Long-Term Benefits of Trading Plans

Trading plans can change your relationship with trading. They can help you stop chasing ‘bright and shiny’ stocks and start making calculated trades.

So much in trading is beyond your control. But you can control when you exit and enter of trades.

Learning how to create a plan is essential to your trading education.

Frequently Asked Questions About Trading Plans

Here are some common questions about trading plans…

Who Uses a Trading Plan?

Any trader can and should make plans — new traders, long-time traders, day traders, swing traders. It’s a key step. If you want to be a smarter trader, consider using one.

Can I Alter My Trading Plan Any Time?

Of course! Don’t set your plans in stone. They’re something you’ll work on and improve throughout your trading career. That said, stick to your plan once you’re in a trade. Remember your entry/exit and risk management.

What Key Elements Should Be in a Trading Plan?

At a minimum, set your entry and exit, risk management, and trading goals. Those are the key elements of any plan. You can include as much detail as needed for your research. Remember, the details you track for every trade can help your analysis down the road.

What’s Next?

Using the tips I just gave you, take the time to learn how to craft your trading plan. Test strategies to find what works best for your trading goals.

And if you’re looking to take your trading to the next level, consider joining the SteadyTrade Team. It’s a community of dedicated traders from around the world, run by seasoned pros.

Our SteadyTrade Team mentorship program is all about helping traders learn to navigate today’s volatile markets. Sign up for the SteadyTrade Team today!

Conclusion

Adaptation is a key to surviving the markets. Building a trading plan around the ever-changing market can help you find your edge.

That’s why it’s important to study up and continue to learn.

Adapting doesn’t have to mean changing your risk levels or goals. Keeping those in mind will help you stay true to yourself while finding your way forward.

Now, time to get your trading plans in order!

How do you plan your trades? What’s essential for your plans? Let me know with a comment below!