Artificial Intelligence (AI) penny stocks represent a high-risk, high-reward segment of the stock market, where shares trade at relatively low prices — often below $5. These stocks are typically associated with small, yet innovative companies focusing on integrating AI into various products and services. For investors and traders, these stocks offer a speculative opportunity to get in on the ground floor of potential technological breakthroughs. However, due to their volatility and these companies’ early stage, they require rigorous analysis and a keen eye for market trends.

Table of Contents

- 1 10 AI Stocks to Watch

- 2 What Are AI Stocks?

- 3 What Is Artificial Intelligence?

- 4 Advantages of Trading AI Stocks

- 5 What To Look for in an Artificial Intelligence Penny Stock

- 6 Where To Buy AI Penny Stocks

- 7 10 Best AI Stocks for April 2024

- 7.1 1. SoundHound AI Inc (NASDAQ: SOUN) — The Former Runner With NVIDIA News

- 7.2 2. Applovin Corp (NASDAQ: APP) — Our Number-One IRIS Pick Right Now

- 7.3 3. Snap Inc (NYSE: SNAP) — The Potential Winner of the TikTok Ban

- 7.4 4. Safe & Green Development Corp (NASDAQ: SGD) — The Data Center Penny Stock

- 7.5 5. Gaxos.AI Inc (NASDAQ: GXAI) — The Chat Pump Former Runner

- 7.6 6. Super Micro Computer, Inc (NASDAQ: SMCI) — The AI Sector Leader That’s Moving Like a Penny Stock

- 7.7 7. AXT Inc. (NASDAQ: AXTI) — The Earnings Winner With Good Consolidation

- 7.8 8. Beamr Imaging Ltd (NASDAQ: BMR) — The NVIDIA Partnership AI Stock

- 7.9 9. Palantir Technologies Inc (NYSE: PLTR) — The AI Stock Leader That’s Gaining on Results

- 7.10 10. Airship AI Holdings Inc (NASDAQ: AISP) — The AI Stock With a Government Contract

- 8 AI Stocks Under $5

- 9 Key Takeaways

- 10 FAQs

10 AI Stocks to Watch

My top AI stock picks for April — rated on chart pattern, price action history, and catalyst — include the following:

| Stock Ticker | Company | Performance (YTD) |

| NASDAQ: SOUN | SoundHound AI Inc | + 172.60% |

| NASDAQ: APP | Applovin Corp | + 78.00% |

| NYSE: SNAP | Snap Inc | – 30.14% |

| NASDAQ: SGD | Safe & Green Development Corp | – 40.64% |

| NASDAQ: GXAI | Gaxos.AI Inc | + 49.88% |

| NASDAQ: SMCI | Super Micro Computer, Inc | + 262.91% |

| NASDAQ: AXTI | AXT Inc. | + 90.69% |

| NASDAQ: BMR | Beamr Imaging Ltd | + 239.64% |

| NYSE: PLTR | Palantir Technologies Inc | + 37.48% |

| NASDAQ: AISP | Airship AI Holdings Inc | + 384.21% |

You can see how the plan with AI penny stocks is rarely buy-and-hold…

Trading these penny stocks should be approached with a clear strategy and an understanding of the risks involved.

Jump ahead to get to my trading plans for these top AI stocks!

What Are AI Stocks?

AI stocks encompass shares of companies that are engaged in the research, development, and commercialization of artificial intelligence technology. These can range from large tech conglomerates to niche startups, each offering their unique contribution to the advancement of AI.

Putting these securities in your portfolio means putting money behind the transformative potential of AI to revolutionize industries, from healthcare to finance, and beyond. These stocks are attractive to investors looking to capitalize on the growth of smart technology and automation. However, as with any investment, they come with varying levels of risk and exposure to the rapidly evolving tech landscape, where today’s leader can quickly become tomorrow’s obsolete player.

What Is Artificial Intelligence?

Artificial Intelligence (AI) is a game-changer in today’s world. It’s a technology that enables machines to mimic human intelligence. AI is not just about robots; it’s about software, algorithms, and machine learning. It’s about creating systems that can learn, adapt, and potentially act autonomously. AI is used in a wide range of sectors, from self-driving cars to advertising, and it’s transforming the way businesses operate.

AI is also making waves in the stock market. It’s being used to analyze vast amounts of data, predict market trends, and make trading decisions. AI is not just for big tech companies like Microsoft; it’s also being used by penny stock companies to drive growth and innovation. But remember, while AI has the potential to revolutionize industries, it also comes with risks. As traders, we need to understand these risks and make informed decisions.

Advantages of Trading AI Stocks

AI penny stocks can be bought at a low cost, offering traders an entry point into the innovative world of artificial intelligence without a hefty initial investment.

Trading AI stocks can offer several advantages. One of the key benefits is the potential for high growth. AI is a rapidly expanding sector, and companies that are developing innovative AI solutions can see significant growth. This growth can translate into an increase in share price, providing opportunities for traders to make gains.

However, trading AI stocks is not without risk. These stocks can be volatile, and there’s always the risk of losses. But remember, as traders, we don’t fear risk; we manage it. We use tools and strategies to limit our losses and maximize our gains. We don’t just blindly invest in AI stocks; we trade them based on patterns, data, and market insights.

The AI sector’s expansion offers traders the chance to ride the wave of companies at the forefront of innovation. With AI transforming industries, the stocks that stand out are those with solid use cases and robust technology. For those looking to keep their portfolios as sharp as their trading strategies, studying up on the past top artificial intelligence stocks to watch is key. This list not only highlights the movers and shakers of early 2023, but also provides insights into why they were the ones to watch.

What To Look for in an Artificial Intelligence Penny Stock

Due to their nature, AI penny stocks are subject to significant price volatility, which requires traders to stay vigilant and responsive to market changes. These stocks require thorough research and due diligence, as the AI field is rapidly evolving and can significantly impact stock values.

When diving into AI penny stocks, it’s not just about spotting the right chart patterns or trading volumes. It’s about understanding the underlying technology and its market potential. Knowing what makes an AI company stand out can be the difference between a savvy trade and a shot in the dark. For a deeper dive into the critical factors that can signal a strong AI penny stock, this guide on what to look for in publicly traded AI companies’ stocks is an invaluable resource for traders aiming to make informed decisions.

Here’s the step-by-step:

Exhibits a Tradeable Pattern on its Stock Chart

First, look for a tradeable pattern on the stock chart. Patterns can give us insights into potential price movements. For example, a breakout pattern could indicate that the stock price is about to rise. But remember, patterns are not guarantees; they are just one tool we use to make trading decisions.

Is a Low-Float Stock

Second, consider whether the stock is a low-float stock. Low-float stocks have fewer shares available for trading, which can lead to higher volatility and potentially higher gains. But be careful, high volatility also means higher risk.

Exhibits an Unusual Trading Volume

Third, look for unusual trading volume. A sudden increase in trading volume could indicate that something significant is happening with the company, such as a new product launch or a major contract win.

Is a Former Runner

Fourth, check if the stock is a former runner. Former runners are stocks that have had significant price increases in the past. These stocks can potentially run again, providing opportunities for gains.

Gets Frequent Media Attention

Finally, pay attention to media coverage. Stocks that get frequent media attention can see increased investor interest, which can drive up the share price.

Where To Buy AI Penny Stocks

AI penny stocks may provide high return potential, but it’s crucial to understand where and how to engage with these investment opportunities. They are often less liquid than higher-priced stocks, making it essential to plan entry and exit strategies carefully.

There are several places where you can buy AI penny stocks.

NYSE/Nasdaq Penny Stocks

You can find AI penny stocks on major exchanges like the NYSE and Nasdaq. These stocks are subject to strict listing requirements, which can provide a certain level of security for investors.

OTC Penny Stocks

You can also find AI penny stocks on the Over-the-Counter (OTC) market. OTC stocks are not subject to the same listing requirements as NYSE/Nasdaq stocks, which can make them riskier. But remember, with higher risk comes the potential for higher returns.

The Best Place to Buy Tech Penny Stocks

The best place to buy tech penny stocks depends on your trading strategy and risk tolerance. Some traders prefer the security of NYSE/Nasdaq stocks, while others are willing to take on the risk of OTC stocks for the potential of higher returns.

10 Best AI Stocks for April 2024

My best AI stocks to watch are:

- NASDAQ: SOUN — SoundHound AI Inc — The Former Runner With NVIDIA News

- NASDAQ: APP — Applovin Corp — Our Number-One IRIS Pick Right Now

- NYSE: SNAP — Snap Inc — The Potential Winner of the TikTok Ban

- NASDAQ: SGD — Safe & Green Development Corp — The Data Center Penny Stock

- NASDAQ: GXAI — Gaxos.AI Inc — The Chat Pump Former Runner

- NASDAQ: SMCI — Super Micro Computer, Inc — The AI Sector Leader That’s Moving Like a Penny Stock

- NASDAQ: AXTI — AXT Inc. — The Earnings Winner With Good Consolidation

- NASDAQ: BMR — Beamr Imaging Ltd — The NVIDIA Partnership AI Stock

- NYSE: PLTR — Palantir Technologies Inc — The AI Stock Leader That’s Gaining on Results

- NASDAQ: AISP — Airship AI Holdings Inc — The AI Stock With a Government Contract

AI was one of the hottest sectors in 2023…

My students have watched hot runners like AMST, PBTS, POAI and more. More importantly, they’ve managed to stay safe because they remember the rules of trading…

These companies are leveraging AI technology and analytics to drive growth and innovation. But remember, just because a company is in the AI sector doesn’t mean it’s a good investment. Always do your research and make informed trading decisions.

AI penny stocks can be part of a diversified investment portfolio, offering a balance between traditional investments and the cutting-edge technology sector. They benefit from advancements in AI technology, which can lead to significant growth as new applications are discovered and implemented.

Here’s the AI stock cheatsheet:

- What is the most promising AI stock?

A sector leader like NVIDIA Corp (NASDAQ: NVDA) is the best bet for the most promising AI stock. But remember, we’re traders, not investors. So the stocks on this list are ones we’re watching for short-term moves, not predictions of which will lead stock exchanges in 2030.

- What are the top 3 AI stocks to buy now?

My top 3 AI stocks to buy now (as long as their price action is strong) are Microsoft Corporation (NASDAQ: MSFT), Super Micro Computer, Inc (NASDAQ: SMCI), and CrowdStrike Holdings, Inc. (NASDAQ: CRWD).

- Which company is most advanced in AI?

NVIDIA is the most advanced publicly traded company in AI, that’s why it’s the sector leader. But other leading tech stocks like Apple, Microsoft, Google, and Facebook are all safe bets to pull ahead at some point.

- Which Artificial Intelligence stocks have a “Strong Buy” analyst rating?

Analysts tend to love these tech leaders — NVIDIA, Apple, Microsoft, Google, and Facebook. Most analysts have rated all of these stocks as “strong buys.”

Before you send in your orders, take note: I have NO plans to trade these stocks unless they fit my preferred setups. This is only a watchlist.

The best traders watch more than they trade. That’s what I’m trying to model in this article. Pay attention to the work that goes in, not the picks that come out.

Sign up for my NO-COST weekly watchlist to get my latest picks!

1. SoundHound AI Inc (NASDAQ: SOUN) — The Former Runner With NVIDIA News

My first AI stock pick is SoundHound AI Inc (NASDAQ: SOUN).

This company works in “conversational intelligence.” Essentially it helps business people communicate if there are language barriers.

It’s already one of the market’s most well-known AI runners. SOUN’s chart history is impressive, to say the least.

Always remember that past spikers can spike again.

The chart shows a big run at the very end of 2022. And that was just a foreshadow of what was to come …

When the AI boom started in early 2023, SOUN was one of the first stocks to run. And in recent months the momentum is back. Take a look at the chart:

The price looks a little overextended, but the 2024 catalyst that caused the most recent spike is on another level entirely.

We could see even higher prices for this stock.

Why I Like It

On February 15 it was announced that NVIDIA Corporation (NASDAQ: NVDA) bought a stake in SOUN.

NVDA is the star of the U.S. stock market this year. The company’s microchips are at the center of this AI and tech boom.

Given the strength of NVDA this year and the added momentum from the tech sector, it’s no surprise SOUN launched 520%.

There’s still risk involved for traders eyeing this stock. But we can use areas of support and resistance to build strategic positions.

Take a look at the most recent SOUN spike with areas of support and resistance drawn in:

Plan your trade carefully.

2. Applovin Corp (NASDAQ: APP) — Our Number-One IRIS Pick Right Now

My second AI stock pick is Applovin Corp (NASDAQ: APP).

IRIS is our AI stock picker.

See, before I learned about the profit opportunities among small-cap spikers, I used to swing trade larger stocks.

It’s still a viable strategy. And thanks to AI, I was able to automate it.

IRIS scans the market 24/7 to find stocks that match my swing trading framework.

Some of these plays are higher priced … That’s because they’re real companies with real financials and revenue. Compared to volatile penny stocks, which are usually just crap businesses in disguise.

That’s why we swing trade higher-priced plays and only day trade volatile penny stocks.

A trader’s profit angle in the market depends on what works best for them.

I included both kinds of opportunities in this watchlist because there’s SO MUCH opportunity right now.

Why I Like It

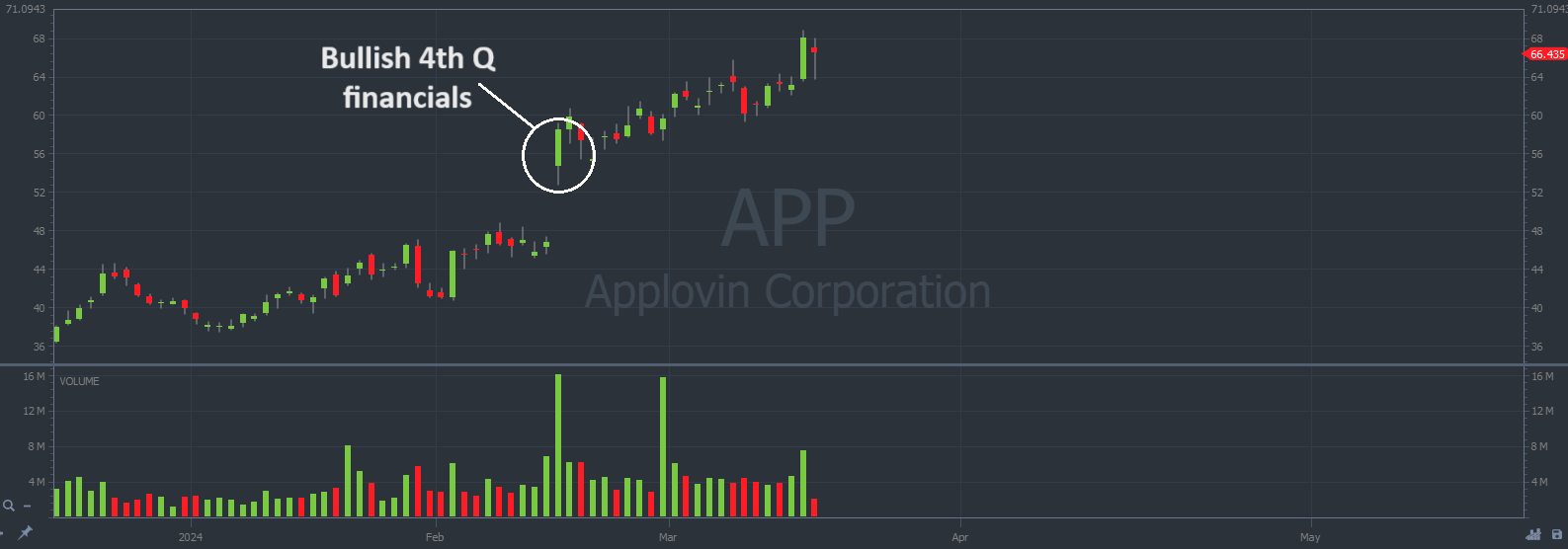

The price gapped up on March 15 after fourth-quarter financial data surpassed expectations. The company attributed a fair chunk of its success to a brand new AI advertising engine.

Ever since the announcement, prices continued to climb. The entire move already measures 45%.

Take a look at the chart below, each candle represents one day:

The intraday moves aren’t explosive like they are for penny stocks. That means we don’t have to watch our positions as closely.

Swing trading is a viable strategy for traders right now. It all depends on what works best for YOU.

APP is IRIS’s favorite swing trade setup right now.

Click here for the trade breakdown.

3. Snap Inc (NYSE: SNAP) — The Potential Winner of the TikTok Ban

My third AI stock pick is Snap Inc (NYSE: SNAP).

TikTok is on the chopping block in 2024.

In March the U.S. government spoke at length about a potential ban of the Chinese social media giant. A bill passed the house on March 13 in an effort to protect U.S. security interests regarding Tik Tok use.

The bill then moved to the Senate floor where its future is less certain.

Whether or not there’s a Tik Tok ban, and regardless of how that takes effect, this issue is likely already at the forefront of many U.S. citizens’ minds.

I’m anticipating volatility surrounding this subject … That’s all.

We don’t have to predict which way the price goes or how long the move will last, nothing like that.

We just need to be prepared for any possible volatility.

Why I Like It

SNAP is a social media platform that’s already popular and headquartered in the U.S., Santa Monica, California.

Again, we’re waiting for some bullish volatility before we plan a trade.

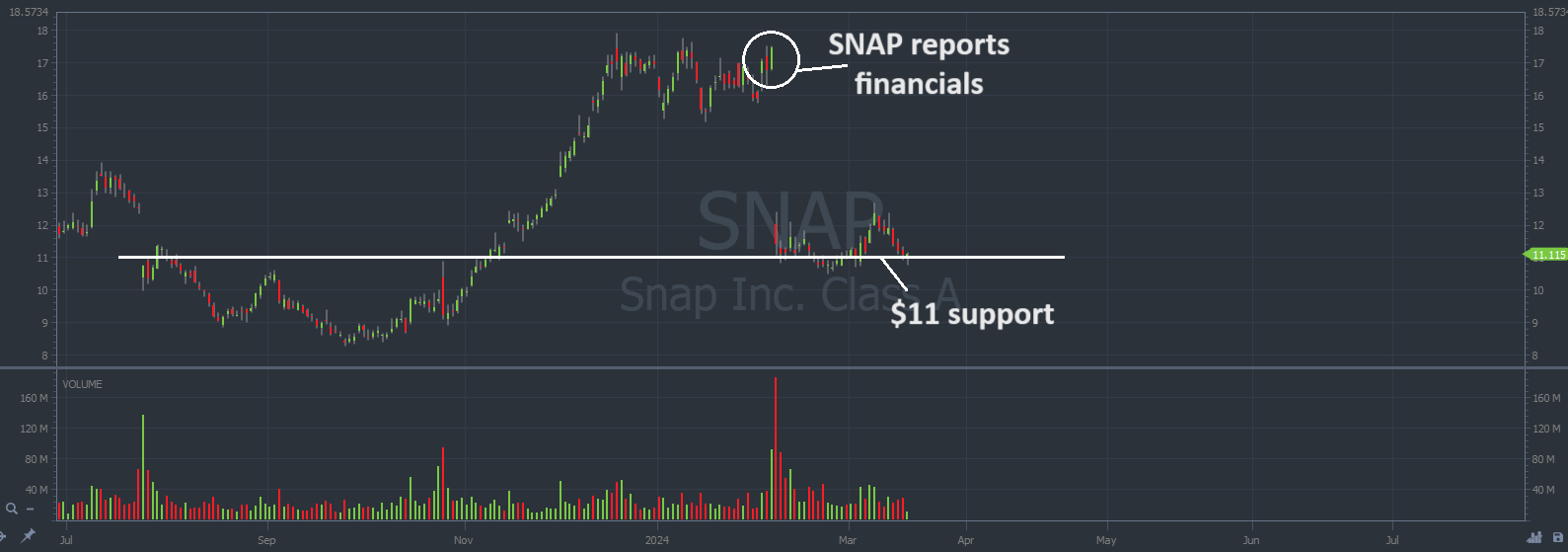

On February 6 the company announced poor quarterly financials and a significant drop in Daily Active Users (DAUs). The stock opened 30% lower on February 7.

There’s daily support around $11 shown on the chart below.

Wait until you see obvious Tik Tok volatility on the SNAP chart.

We want confirmation of the move before we put any money behind it.

4. Safe & Green Development Corp (NASDAQ: SGD) — The Data Center Penny Stock

My fourth AI stock pick is Safe & Green Development Corp (NASDAQ: SGD).

This is a great example of a crappy penny stock to keep on your watchlist.

The spikes are unsustainable. But we can pull profits from the volatility with popular patterns BEFORE the price craps out.

And there’s a lot on the table …

In less than 2 days during November 2023, SGD spiked 1,600%.

And this year, on March 8 it launched 310%.

Take a look at the chart below, every candle represents one trading day:

Why I Like It

For these volatile penny stocks, it’s not a question of if, but when.

Past spikers can spike again.

We already know that this stock can run. The company knows how to pump the price. And it’s only a matter of time until they try again.

The most recent run, on March 8, was the result of a secured financing announcement for the company’s business expansion in Atlanta, Georgia.

We’re waiting for more bullish news like that. It’s evidence of obvious value added followed by volatile price action.

Plus, StocksToTrade shows there are only 2.9 million shares in the float.

Anything below 10 million shares is considered a low supply. And the low supply of shares helps prices spike higher when demand increases.

SGD is a ticking time bomb waiting for another catalyst.

5. Gaxos.AI Inc (NASDAQ: GXAI) — The Chat Pump Former Runner

My fifth AI stock pick is Gaxos.AI Inc (NASDAQ: GXAI).

I’m still waiting for a giant squeeze from this crappy stock.

On February 16 it announced some wimpy AI news. StocksToTrade Breaking News alerted the move before the market opened for regular hours.

Take a look:

WOW! Want to see how trading a Breaking News Chat alert plays out? @timothysykes scored a 94% gain today with our Breaking News alert!

— StocksToTrade (@StocksToTrade) February 16, 2024

Missed the $GXAI alert? The stock was also on our morning top % gainers list we shared before the open!

Sign up to get the next Breaking News… pic.twitter.com/HonSV6ARdI

The price launched 520% that day.

Why I Like It

It’s still holding some of those gains. There’s noticeable support at $5.

In the chart below, every candle represents one trading day:

And GXAI’s fluffy AI news wasn’t the only catalyst on February 16.

That same day, the market’s biggest 2024 short squeeze, MicroCloud Hologram Inc. (NASDAQ: HOLO) was breaking out to all-new highs. Which means GXAI is a short squeeze sympathy play.

HOLO wasn’t the first short squeeze of 2024 … And it wasn’t the last. This is a hot catalyst right now. There are a lot of overaggressive short sellers trying to ride crappy stocks lower.

GXAI is a crappy stock …

There’s no telling when the short squeeze could start. Keep an eye on that $5 support level. If prices fall below support, the stock falls out of play.

6. Super Micro Computer, Inc (NASDAQ: SMCI) — The AI Sector Leader That’s Moving Like a Penny Stock

My sixth AI stock pick is Super Micro Computer, Inc (NASDAQ: SMCI).

This is a higher priced stock. But it’s an essential watch in 2024.

Why I Like It

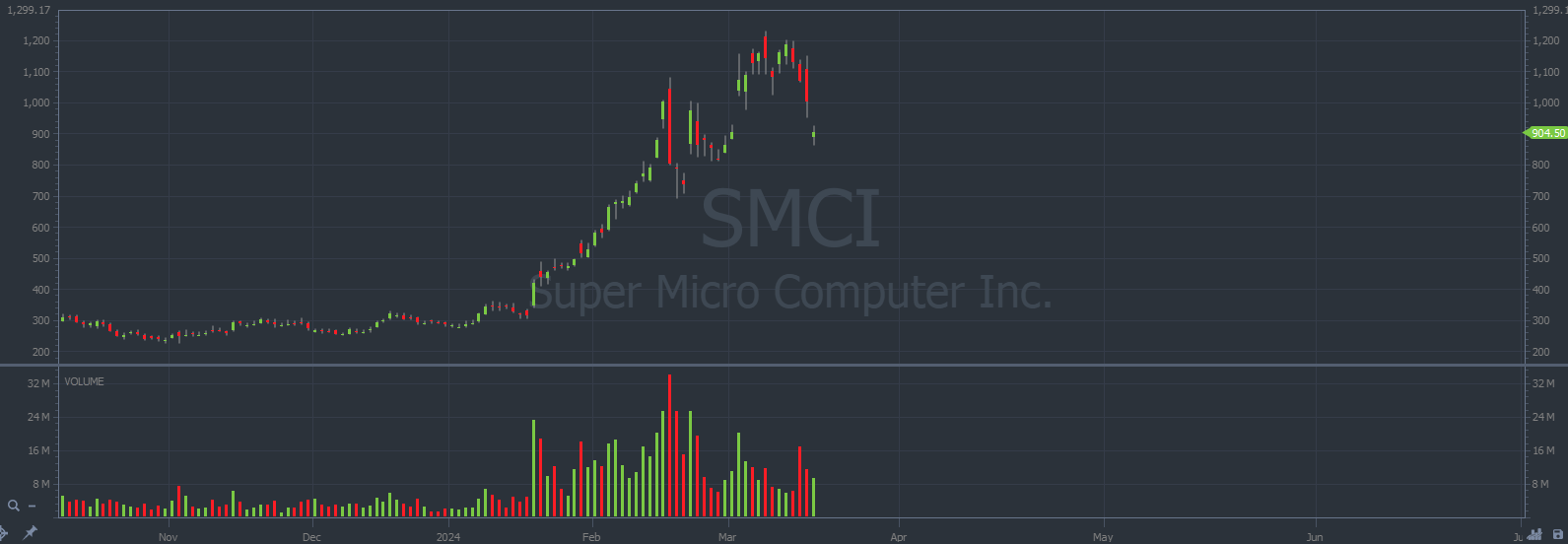

It was trading below $100 per share in 2023 when the AI boom started.

In 2024 the share price launched past $1,000.

This is a newly minted mega-cap tech stock thanks to the market’s AI momentum. And the chart makes it look like a penny stock:

We keep an eye on stocks like SMCI so that we’re ahead of the curve for low-priced plays that spike in tandem.

But if you’re interested, there are options traders using mega-cap price action to profit.

There’s so much opportunity in this 2024 market. Pick a strategy and hit the ground running!

7. AXT Inc. (NASDAQ: AXTI) — The Earnings Winner With Good Consolidation

My seventh AI stock pick is AXT Inc. (NASDAQ: AXTI).

On Thursday, February 22 during the afternoon, AXTI held an earnings call.

This is a direct excerpt from the call:

“Sales grew 10% in the quarter with early signs of recovery in the power market and brand new demand related to artificial intelligence.”

Dr. Morris Young, Chief Executive Officer of AXTI

Shares started to move during after-hours. It gapped up the next morning and continued in the following days. The initial spike measures 130%.

Why I Like It

Strong earnings is a great catalyst. Especially for a tech stock during this AI boom.

That’s not all, when we see a stock consolidate sideways after a big initial spike, it’s a hint the price could continue higher.

The chart shows resistance at $5.50 and support at $4.

Prices have to cross one of those lines eventually. And I expect the move to be explosive.

8. Beamr Imaging Ltd (NASDAQ: BMR) — The NVIDIA Partnership AI Stock

My eighth AI stock pick is Beamr Imaging Ltd (NASDAQ: BMR).

On February 12, at 7 A.M. Eastern during premarket hours, BMR announced a partnership with NVIDIA Corporation (NASDAQ: NVDA).

A hook up with a sector leader like NVDA is HUGE news for a penny stock. We already saw what happened to SOUN.

The share price spiked 1,500% in less than 24 hours. Since then, the stock lost 70% of its value. But there’s a possible squeeze brewing …

Why I Like It

It reminds me of another intense spiker that started running only a few days earlier on February 7.

MicroCloud Hologram Inc. (NASDAQ: HOLO) managed to spike 2,600% in a similarly spectacular fashion.

Like BMR, the price slid lower, but HOLO consolidated for a few days and broke out to reach $98 per share!

HOLO was trading below $2 less than two weeks before … That’s a 6,400% move in total.

BMR was trading below $3 before its spike on February 12 …

And currently, BMR is consolidating above support despite a February 14 offering of 400,000 shares.

It’s not a 100% guarantee that BMR will push to new highs.

Nothing is guaranteed when it comes to the stock market.

But we know that volatile stocks can follow popular patterns. If BMR breaks out, there are patterns we can use to trade the price action.

9. Palantir Technologies Inc (NYSE: PLTR) — The AI Stock Leader That’s Gaining on Results

My ninth AI stock pick is Palantir Technologies Inc (NYSE: PLTR).

There’s a growing concern about AI’s utilization by scammers, criminals, and enemies of the state to disrupt and prey on our society at large.

Hopefully you weren’t the victim of a scam like the one below:

Source: The New Yorker

As a result, companies like PLTR are increasing the strength of their services to combat this growing risk.

This niche is essential in the AI industry.

Why I Like It

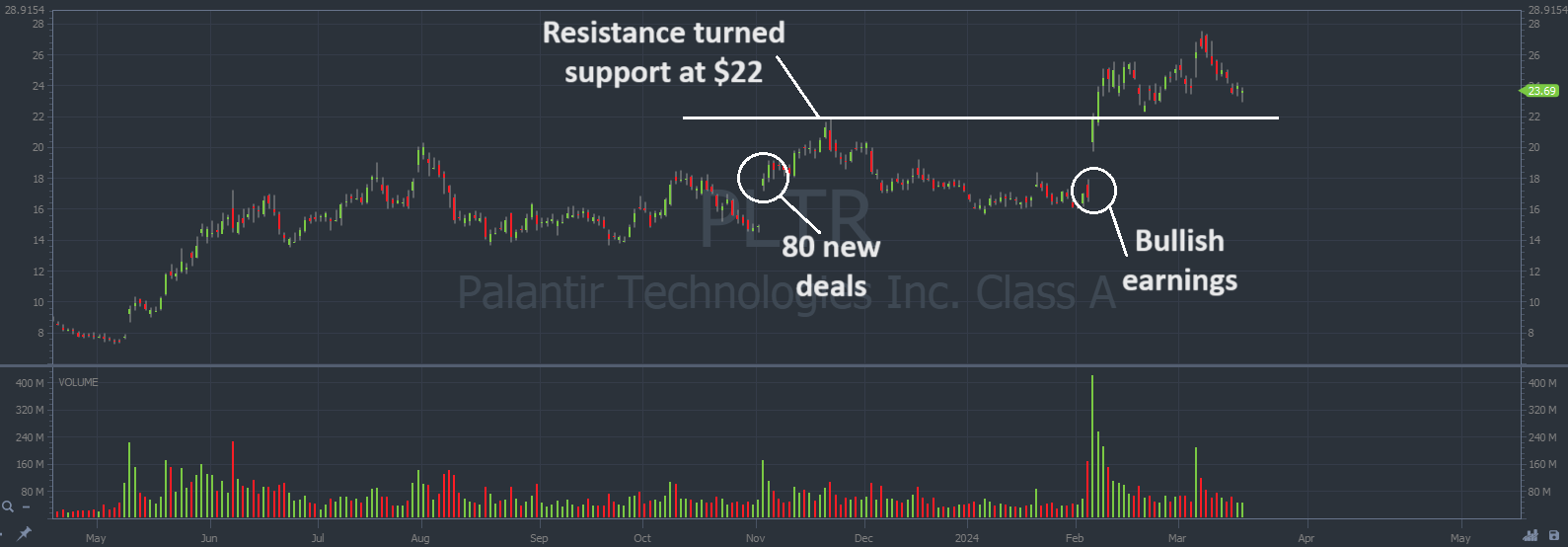

PLTR announced that it secured 80 new deals in the third quarter of 2023. Each deal was valued at $1 million or more. That’s pretty easy math … More than $80 million.

The stock spiked up to $22 within the month. That was the breakout level.

On February 5 an earnings report came out while the market was closed. The next day, prices gapped up 20% and continued the spike to an impressive 50% in the following days.

PLTR reacts well to bullish news. And we can see that it follows support and resistance.

Wait for the next hot catalyst to move this stock.

10. Airship AI Holdings Inc (NASDAQ: AISP) — The AI Stock With a Government Contract

My tenth AI stock pick is Airship AI Holdings Inc (NASDAQ: AISP).

Anyone who thinks penny stock volatility is a random phenomenon probably has no experience trading these runners.

On March 5 at 8:31 A.M. Eastern, AISP announced a new government contract with the U.S. Department of Justice. Government news is HUGE for a penny stock.

The spike already measures 760%. Some people might even call it overextended.

Why I Like It

Nobody knows how far these plays could run.

Don’t buy and hold at random. But definitely don’t count them out.

There’s still a lot of intraday volatility we can take advantage of. Make sure you’re trading with a plan. And make sure to follow your plan!

Discipline is everything.

Small losses are fine. But don’t let those losses grow into something bigger. If a trade starts to act funny, cut it. Worst case scenario, you can always get back in later.

AI Stocks Under $5

The allure of hot sector stocks, especially when they’re also penny stocks, is undeniable. These stocks present a unique blend of opportunity and volatility. The AI industry is booming, with advancements and applications spreading across various sectors, from healthcare to finance, making AI stocks a magnet for investors looking for the next big thing. The gains here can be proportionately greater than those from more established stocks, mainly because even minor positive news or advancements can send their prices soaring.

However, it’s crucial to approach these opportunities with a clear strategy and an understanding of the risks involved. The volatility of penny stocks, combined with the speculative nature of AI ventures, means that while the potential for rapid gains is significant, the risk of losses is equally high. Conduct thorough research, looking beyond the hype. And never invest in these stocks — only trade them.

Remember, the key to success in trading AI stocks under $5 is not just about jumping on every opportunity but being selective and strategic. It’s about leveraging the explosive potential of the AI sector while managing risk meticulously. By focusing on companies with the potential to lead in their niche, traders can capitalize on the disproportionate gains that these penny stocks offer, all while keeping their investment strategy tight and cutting losses quickly.

Key Takeaways

Trading AI penny stocks can offer opportunities for gains, but it also comes with risks. As traders, we need to understand these risks and make informed decisions. We don’t just blindly invest in AI stocks; we trade them based on patterns, data, and market insights. And remember, small gains add up. Don’t get caught up in the hype of AI; focus on the facts, the data, and the patterns. That’s how we trade AI penny stocks.

Key points:

- Investing in AI penny stocks can be risky due to lack of company information, making transparency and communication key factors to consider.

- These stocks could experience rapid growth with AI sector advancement, positioning them as attractive for those looking to capitalize on technological trends.

- AI penny stocks are influenced by technological developments and patents, which can dramatically alter their trajectory and market value.

These stocks follow the rules of all hot sectors. They’re good for trading because they’re hot…

That’s the same thing that makes them dangerous when their sector cools down.

It isn’t enough to form a thesis on which stocks to buy. Making a profit depends on a good trading plan.

And that depends on your stock research and analysis tools.

I use StocksToTrade to scan for news, tweets, earning reports, and more — all covered in its powerful news scanner.

It has the trading indicators, dynamic charts, and stock screening capabilities that traders like me look for in a platform. It also has a selection of add-on alerts services, so you can stay ahead of the curve.

Grab your 14-day StocksToTrade trial today — it’s only $7!

Trading can be dangerous. Most traders lose money.

A 2019 study called “Day Trading for a Living?” looked at the success rates of Brazilian traders over a 2-year window, and found that 97% of traders with more than 300 days of active trading lost money. Only 1.1% earned more than the Brazilian minimum wage — that’s only $16 per day!

If you want to be part of the 1%, make sure you outwork the rest!

What AI penny stocks do you have on your watchlist? Let me know in the comments!

FAQs

How can AI platforms like ChatGPT contribute to the growth of penny stocks in the AI industry?

AI platforms like ChatGPT and related applications are driving significant innovation in various industries. The growing demand from customers for AI-driven solutions is leading to increased market cap and revenues for companies in the AI space, including those whose shares are classified as penny stocks.

Where can I find the latest news and information about AI penny stocks?

For the latest news and market updates on AI penny stocks, you can explore our markets section. It provides in-depth content, links to reliable sources, and recent results related to AI companies and their stocks.

How can I assess the value of an AI penny stock?

The value of AI penny stocks can be assessed by evaluating several factors. These include demand for AI solutions, people involved in the company, and its market cap. Revenue, earnings, and momentum of the stock in the market are also crucial considerations.

When should I consider selling my AI penny stocks?

Deciding when to sell your AI penny stocks involves evaluating your profit margins and market conditions. It’s generally a good idea to sell if you’ve achieved your desired profit or if there are signs of a downturn in the market. Always consult with a financial advisor to make the most informed decisions.