“Success consists of going from failure to failure without loss of enthusiasm.” – Winston Churchill

Successful trading strategies are not about winning every single trade. Even the most experienced traders suffer losses and setbacks at one point or another. Success is how you deal with it.

It’s the point you reach when you’ve achieved the financial goal you set at the beginning of the year, month, or week. It’s about sticking to your plan, no matter what. It’s about taking control of your emotions and, well, being a man (or a woman). It’s not how hard you fall, it’s how fast you get up.

Losses are part of the trading game.

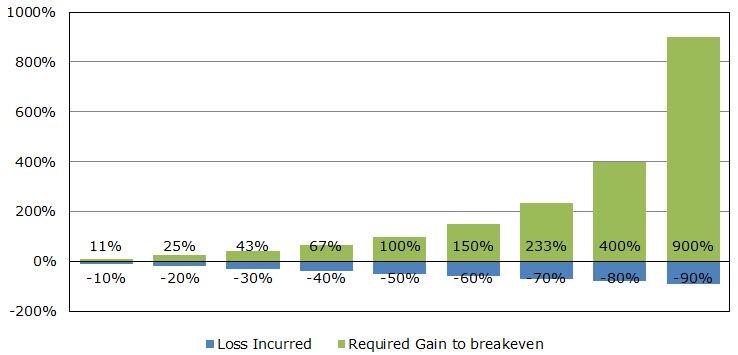

So, what happens if you lose 10% of your investment? Do you need to recover 10% in order to break even? Well, no. You need to gain more to make it even. And the steeper the loss, the more you need your portfolio to rise to offset that loss.

Why is that, exactly? Doesn’t a 10% loss equal a 10% gain to break even, or 20% equal 20%? Actually, no, it doesn’t. The underlying math in these calculations is that we take how much you have now as the starting point, and begin calculating the necessary return percentages from there.

Download a PDF version of this post as PDF.

Here’s a very simplified example:

Let’s say that your investment is worth $100. If you made a 10% gain last week, then your portfolio is worth $110 now. But if you lost 10% over the past week, you now have your investment worth $90. To see how much you need to gain in order to recover the 10% loss, you are now calculating the needed return percentage from what you have now, $90. You need $10 to get back to $100, but this, in percentage terms, means that we’re now dividing 10 by 90 (remember our $90 starting point now), and multiplying the result by 100 to calculate the percent gain you need to get you back to $100. That’s 10 divided by 90, then multiply by 100=11.1%. You need your portfolio to rise by 11.1% to offset a previous loss of 10%.

Then, remember, the bigger the loss in percentage terms, the more you need to recoup to break even. If you lose 50% on the $100, your portfolio is worth $50 now. So the percentage gain you need to get back to $100, is 100%.

Here’s a graph showing how much you need to recover and how the more you lose, the more you need to gain to make it even.

Image source: BizNews.com

Image source: BizNews.com

In a nutshell, smaller losses are much easier to recover. The bigger the loss, the more challenging the breakeven target becomes.

Okay, this was the financial side of recovering from a loss. What’s the psychological part?

First, admit to yourself that you’ve taken a loss. Step away, and don’t try revenge trading to recover losses.

StocksToTrade—now better than ever! We ushered in the New Year with some major advancements that include 3 unique features, exclusive to our platform.

Like with any loss in your life, you need shock therapy to recover from it. The trading loss will affect your decision-making process, so take a breather and give yourself time to heal. You may need to stop trading live for a couple of days, and just play hypothetical trades in your mind, while watching the market.

Or you may need to step away completely for a couple of days or a week, to cope with the stress the loss has caused you. Stress can depress your immune system, or make you irritable, or give you trouble sleeping.

Shut down trading and markets for a few days until you feel you’ve regained your confidence. If fear of losing sweeps over you, step away again. It will not do you any good to have your market/stock judgment clouded. This will only lead to irrational decisions.

You may want to follow a list of simple chores, one by one, one at a time, to take back control of your life, your emotions and your confidence level. Return to trading when you feel ready, slowly at first, to build up your confidence.

Focus on the opportunities that lie ahead, not on regrets.

And most importantly, never, ever, give up. There’s not one successful trader out there who has a perfect 100% winning trades scorecard. Neither should you be focused on winning all the time.

It’s the psychological and financial ability to recover from a loss that will take you to your next trading goal. The thing is to know your financial stops and required gain to offset a loss. The other thing is to know yourself, take care of yourself, and allow yourself to learn and grow as a trader.

If you still need some inspiration—and Churchill just wasn’t enough—there are plenty of traders out there, along with other great minds, who fully understand what it means to lose in order to win:

“Have no fear of perfection – you’ll never reach it.” – Salvador Dalí

“The game taught me the game. And it didn’t spare me rod while teaching.”– Jesse Livermore

“Michael Marcus taught me one other thing that is absolutely critical: You have to be willing to make mistakes regularly; there is nothing wrong with it. Michael taught me about making your best judgment, being wrong, making your next best judgment, being wrong, making your third best judgment, and then doubling your money.” – Bruce Kovner, hedge fund manager

“Losing money is the least of my troubles. A loss never troubles me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocketbook and to the soul.” – Jesse Livermore, Reminiscences Of A Stock Operator

Check out STT’s new Twitter Streams! One of our most important new releases of 2017 is the inclusion of Twitter as a source of data for keeping up to date with the latest social discussions on a given stock. Every Stock tab includes a Twitter data feed which focuses only on tweets mentioning the company being tracked.