Sentiment analysis—the science of analyzing data from social media feeds from Twitter, Facebook and other social networks—has grown into a big business in recent times. Stock trading on twitter is no longer about trying to figure out which of your friends are still using Android. Social Sentiment Indicators, or SSIs, are now making big waves in the stock trading universe as more evidence pours in that proves SSIs provide significant leverage for traders who use the tools compared to those who don’t.

Although traders can use other social media sites, Twitter is the real hotspot of social indicator analysis. Here are a few real-life examples of how traders have used Twitter data in the past to gain a leg up on other traders:

Scenario # 1

It’s early 2013, and erstwhile high-flying smartphone maker BlackBerry Inc.(NASDAQ:BBRY) stock is on the ropes after the company has been hammered by Apple’s touchscreen devices. The Canadian-based company, however, gets some reprieve after Fairfax Financial Holdings Ltd., a Toronto-based investment company, says it’s willing to bail it out with a $4.7 billion buyout offer, a fair premium to the share price. As expected, BBRY stock enjoys a nice rally.

Download a PDF version of this post as PDF.

But the bailout was not to be. On November 11, 2013, a couple of minutes after 8:00 a.m. EST, there was a news leak that the proposed M&A deal had fallen through. A New York City-based social media data analytics firm, Dataminr, got the leak in a matter of seconds and sent alerts to its clients who acted immediately to short/sell BBRY shares. This was a whole 180 seconds before Wall Street got a whiff of the news and belatedly discovered that someone had beaten it to the punch.

Scenario # 2

In August of the same year, another social media analytics firm, Social Market Analytics, used its coverage of 400k Twitter accounts to parse through mountains of tweets, gain business intelligence, and use it to alert its clients about a possible bullish move by Apple Inc. (NASDAQ:AAPL) stock. The alert proved very timely as it came just a few days before activist investor Carl Icahn, who had been strongly bearish on AAPL in the post-Steve Jobs era, tweeted that he had opened a new position in AAPL shares worth $1 billion. Carl called AAPL shares ”extremely undervalued,” which sent them soaring.

Scenario # 3

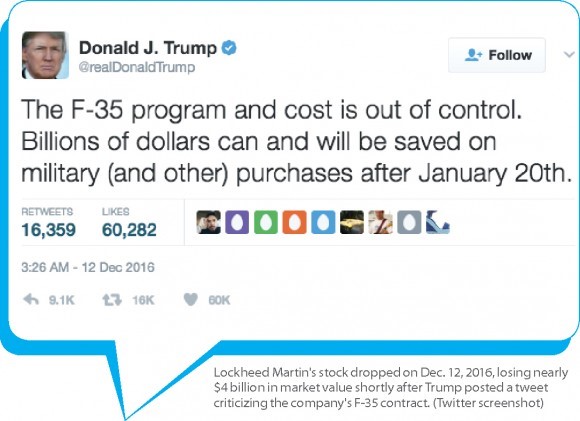

Tweets by influential people can have a powerful effect on stock markets. In December 2016, defense contractor Lockheed Martin (NYSE:LMT), saw its stock lose $4 billion in value after then president-in-waiting, Donald Trump, tweeted that the company’s F-35 program was too costly and vowed to do something about it after his inauguration.

In the above cases, the early-in birds made a bundle before most investors even had any idea what was going on. But these are by no means isolated events. In 2014, financial data services provider, IHS Markit, released findings that social media sentiments are effective signals of future stock performance. The study was done over a two-year period and showed 76% cumulative returns from positive social media sentiment stocks and -14% for negative sentiment stocks.

Back in 2010, business professor Johan Bollen of Indiana University analyzed Twitter feeds using OpinionFinder, a mood tracking tool that measures positive vs. negative moods, as well as Google-Profile of Mood States (GPOMS), another tool that quantifies 6 mood states; namely Alert, Calm, Sure, Kind, Vital, and Happy. The study found that accuracy of predicting daily up and down changes in closing values of the Dow Jones clocked in at an impressive 87.6% when using the social sentiment indicators and was accompanied by a 6% reduction in the mean average percentage error.

In 2012, a study done by Yahoo and UC Riverside found a strong correlation between Twitter sentiments and stock performance for companies with the following:

- Low levels of debt

- Financial performance that tends to fluctuate significantly

- Stocks with high betas; and

- Stocks with low floats.

Using Twitter to predict stock performance like a pro

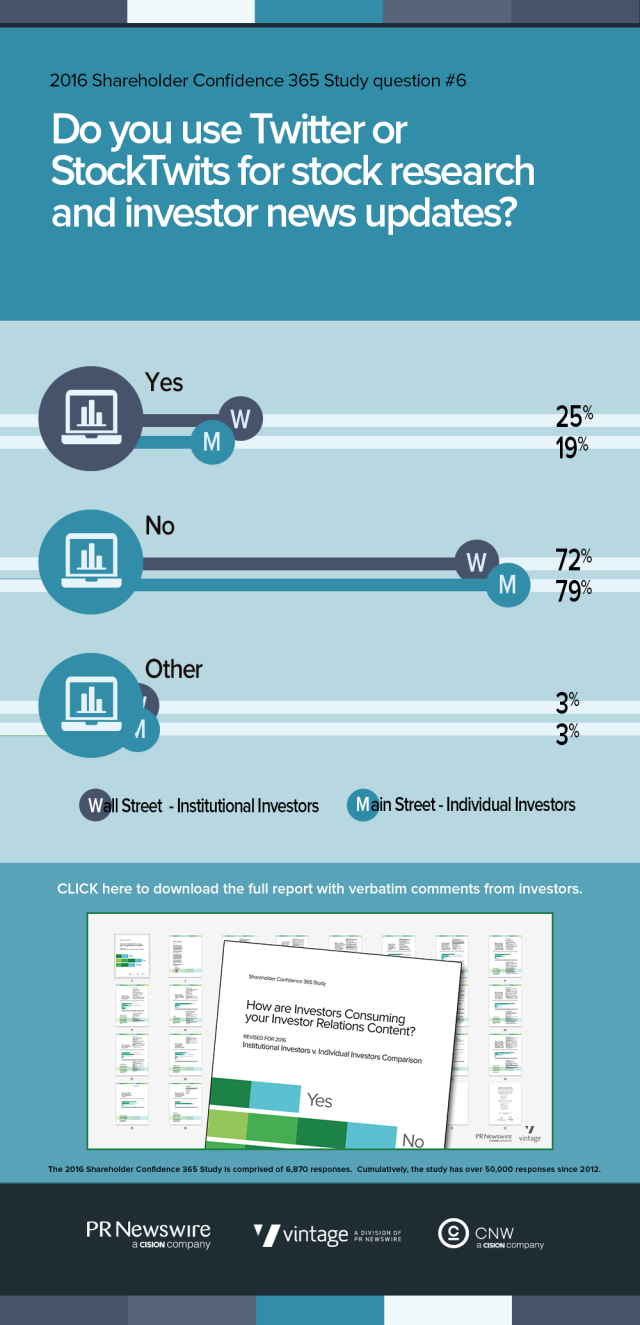

Fortunately, traders do not have to monitor the mountains of tweets posted every day in order to glean useful trading tidbits. They can instead learn how to use some of the data mining tools that hedge funds and institutional investors use. As many as 25% of institutional investors now use social media tools during their research.

Source: Cision Communications Cloud

Source: Cision Communications Cloud

These tools employ artificial intelligence, advanced machine learning, and NLP (Natural Language Processing) to quickly and efficiently analyze millions of messages every day.

Leading data mining tools include:

- Dataminr— a strategic Twitter partner that has direct access to the company’s firehose.

- TickerTags– a social data intelligence company. The first company to successfully call Brexit results. Still in beta mode and free to use.

- Social Media Analytics— quantifies social media data in a way that provides actionable market intelligence for investors.

- Knowsis— a U.K.-based web intelligence company that specializes in extracting information from non-traditional online data sources and presenting it in an actionable format for investors.

If you prefer following Twitter feeds, here are a few good ones:

- @breakoutstocks— good feed if you are looking for hot stocks that have hit new highs or lows. Provides new research ideas, too.

- @stocktwits— a real-time feed that allows traders from around the globe to post their trading moves.

- @cnbc— provides 24-hour finance news coverage and real-time business information for millions of individual and institutional investors.

- @WSJDealJournal— comprehensive coverage of M&A deals.

- @benzinga— useful info on analysts’ upgrades/downgrades as well as technical events such as unusual volumes and price breakouts.

So, will using these Twitter mining data services place you on an even keel with the pros? Err…not exactly. Large funds and even rich individual investors use other alternative tools to make investment decisions, including satellite imagery and good ol’ website data. Some of these data tools are pretty expensive and will set you back between $50k and $3 million per year. Other novel ones like Google-Profile of Mood States are not yet available to the public.

How not to Use Twitter for trading

So much for the Dos. And now the Don’ts. Twitter will occasionally spew forth fake news, usually as a result of hacking attacks. For example, the S&P 500 briefly lost billions in the White House “hash crash” incident, which turned out to be the product of a high-profile hack that led many to erroneous belief that there had been explosions in the White House. The markets were able to regain their footing in a matter of minutes, but the early birds got burnt this time around.

In another even more bizarre incident, a section of investors rushed to buy shares of apparel maker, Lululemon Athletica (NASDAQ:LULU) after receiving strong buy signals from their social media tools. Interestingly, the tools were reacting to sarcastic smileys that people were tweeting after the company announced a massive recall of its see-through yoga pants which were deemed too transparent. Turns out AI systems were still not good enough at dealing with sarcasm. Needless to say, many investors who acted on the Twitter intelligence alone lost a bundle after LULU shares went on to tank wildly.

More recently, there were widespread fears that the markets would react negatively after President Trump’s swearing-in. The reality, though, turned out to be the exact opposite.

These cases are good reminders to cross-check what’s driving the sentiments on Twitter and not just accept everything at face value. Further, it’s important to remember to always augment your Twitter data with solid fundamental and technical analyses. Focus more on the things you can measure and control instead of mere market sentiment that is frequently based only on fear and greed.