According to a recent report by the Wall Street Journal, more than 25 percent of all trading activity now takes place during the final half-hour of the 6.5-hour long trading session.

In 2017, more than 8 percent of trades in S&P 500 stocks happened at the close, according to data from Credit Suisse, with more than $10 billion worth of stocks changing hands at the final auction of the day.

This end-of-day surge in activity has several important implications for traders.

First of all, it can significantly increase liquidity, an important factor for stocks that suffer from low daily volumes. It can also, thankfully, lead to sharper swings thus increasing volatility for day traders.

So, what’s behind this trend and what are other pockets of opportunity are available for traders?

Download a PDF version of this post as PDF.

Rise of a $4 trillion market

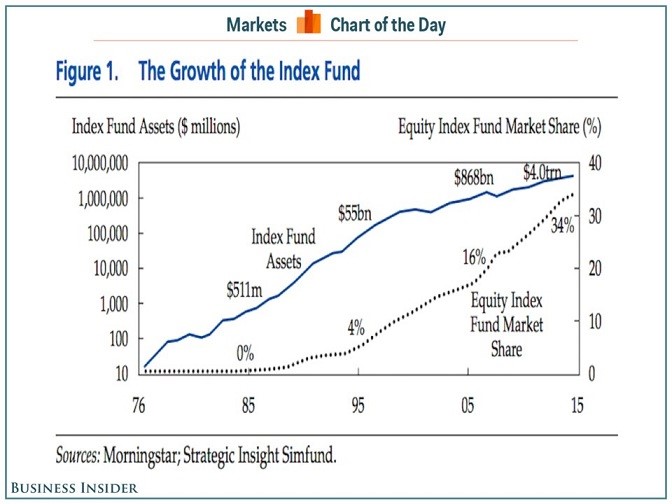

Interestingly, the shift to trading at the close has coincided with another new trend–the proliferation of passive investments such as index funds. Index funds are a relatively new type of fund that aims to replicate stock indices such as S&P 500 or the Russell 2000–an approach that’s alien to traditional actively managed funds which nearly always attempt to beat the market.

Equity index funds have enjoyed exponential growth over the past decade, and now control nearly half of all passive investments. Index fund investments are a huge $4-trillion market.

Source: Business Insider

The main reason index funds have brought about a sharp increase in end-of-day trading is simple: These funds typically update their positions at the end of the day.

Index funds do not trade as frequently as active funds and when they do, they tend to do it near the market close because buying or selling stocks at their closing prices is a fairly reliable method of aligning their performance with that of indices they are trying to emulate.

The other reason is simply that it makes sense to trade when volumes are high.

Hedge funds typically make large volumes of trades at a single go, which can significantly move the price if only a few buyers or sellers are placing trades. It, therefore, makes sense for them to wait until other market participants are willing to play (i.e. at the end of the day). So this has become a self-reinforcing trend that is probably not going anywhere.

Trading and Non-trading Hours

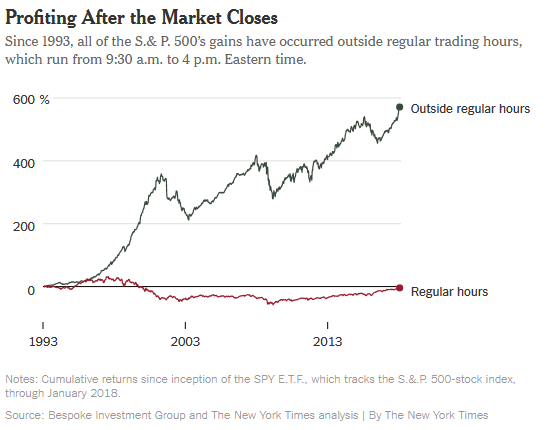

The markets are full of idiosyncrasies, not least the rather bizarre finding that overnight is the time when big money—or ALL money–is made in the stock market. The difference between day returns and overnight returns is literally like, well … night and day.

Comparing stock market returns in the NYSE by looking at prices at the start of trading at 9.30 a.m. to market close at 4 p.m. as well as the reverse i.e. price returns from the close of market at 4 p.m. to the market opening at 9.30a.m. the following day tells it all. You can actually make a bundle by simply buying stocks just before market close, holding overnight and selling immediately after market open the next day. This is made possible by the fact that stock prices tend to be higher at market open than prices at the previous day’s close.

An investment company known as Bespoke Group arrived at this conclusion by looking at the returns by SPDR S&P 500 E.T.F since its inception 25 years ago. This ETF tracks the broad-market S&P 500 and is, therefore, a pretty good proxy for the entire stock market. Had you bought the SPY at the last second of each trading day and sold immediately at market open the following day since 1993, your cumulative gains would be 571%. If, on the other hand, you had taken the reverse route and bought the ETF immediately after market opening and sold just before market close, you would be down 4% over the same timeframe!

You can find the full report here, including hypotheses as to why this is the case.

Source: The New York Times

What’s even more striking is the fact that this trend holds true even when looking at much shorter timeframes. If you had bought the SPY just at market close every day and sold immediately after market open in the period Jan. 2017-Jan. 2018, you would be sitting on a cumulative gain of 13.4%, significantly better than the 9.2% gain you would otherwise have realized by trading during regular hours over the same period. Of course, a little bit of leverage would provide much more oomph to those profits.

Best times to trade

Day traders try to benefit from market volatility in both bull and bear markets. Here are a few tidbits on the best times to buy/sell stocks:

- Best time to buy or sell stocks–opening hours

The first hour of a day’s trading session tends to be highly volatile as the market tries to incorporate news since the last closing bell. For a seasoned trader, the first 15 minutes-1 hour of a trading session represents prime time to buy or sell stocks. Less-skilled traders, though, should avoid placing trades at this time.

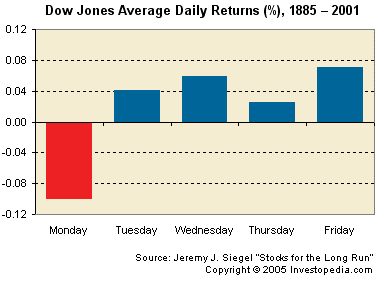

2. Best day to buy stocks–Monday

Source: Investopedia

The Monday Effect is a well-documented tendency for stocks to drop on Mondays. This is a good time to buy on the dip.

3. Best day to sell stocks–Friday

The opposite of the Monday Effect, Fridays are the best days to sell or open short positions. Fridays that fall on the eve of three-day weekends tend to be especially productive.

These are, of course, generalizations since exceptions and anomalies abound. The only par for the course is that the first and final hours of a trading session are almost always the busiest, and therefore tend to offer the most opportunities for day traders.